Ready to capitalize on the explosive growth potential of mid-cap tech companies? This guide explores the Strategic Fortunes investment approach, a structured methodology for identifying and investing in technology firms poised for exponential growth. We'll dissect the four-step process, analyze its strengths and weaknesses, and provide actionable insights for various stakeholders, all while emphasizing crucial risk mitigation strategies. For more information on emerging tech investments, see this helpful guide on Web3 investing.

Understanding the Strategic Fortunes Approach

The Strategic Fortunes approach focuses on mid-cap tech companies (valued between $2 billion and $10 billion) demonstrating significant potential for rapid growth. Unlike speculative betting, this method emphasizes identifying companies on the cusp of a "tipping point"—a moment when an emerging technology becomes mainstream. This involves recognizing a company's unique competitive advantage, what we term its "X-factor," before its value skyrockets.

The Four Steps to Strategic Fortune: A Roadmap to Success

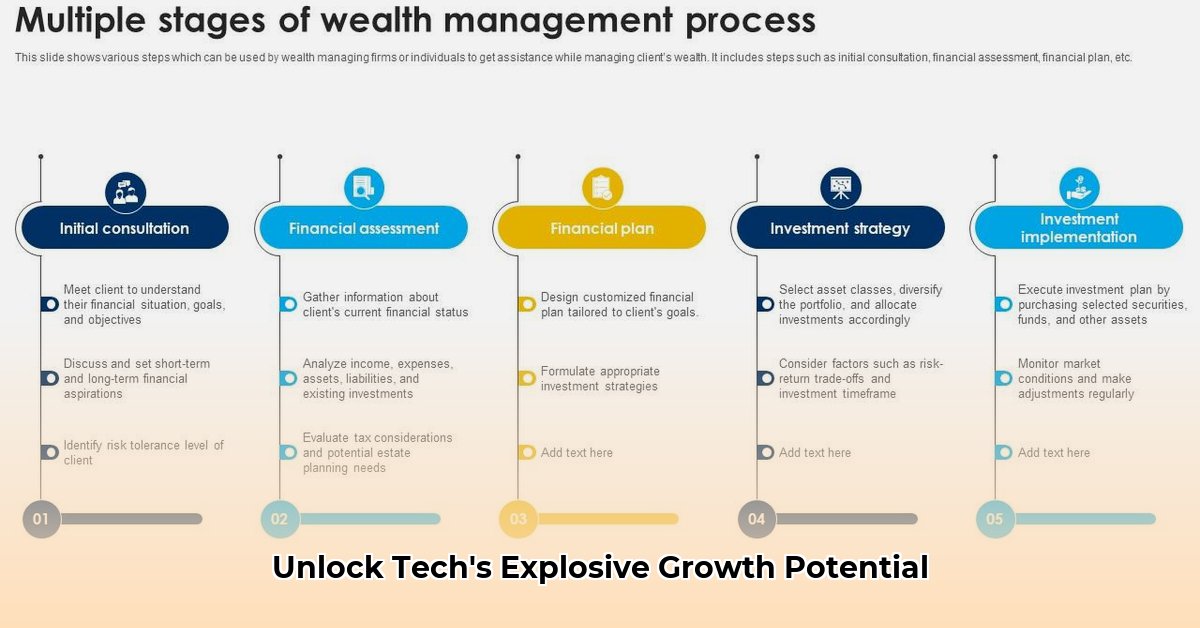

This isn't a get-rich-quick scheme; it requires careful planning and execution. Here's a four-step roadmap:

Identify Tipping Point Trends: Research sectors experiencing rapid technological advancements (e.g., AI, 5G, autonomous vehicles). Pinpoint areas ripe for disruption and significant market expansion. Isn't it fascinating how quickly technologies can transform entire industries?

Uncover the X-Factor: Deeply analyze companies within those sectors. What's their unique competitive edge? Is it innovative technology, a strong management team, a first-mover advantage, or a unique market niche? This "X-factor" is critical for outsized returns. How can investors accurately identify these "X-factors" before the market catches on?

Assess Current Performance: Analyze financial statements, market trends, and investor sentiment. Look for signs of steady growth, increasing market share, and positive momentum. This helps validate the company's potential. What key performance indicators (KPIs) are most crucial for identifying thriving companies?

Master the Timing: Identifying the optimal entry and exit points requires patience and ongoing market analysis. You aim to invest before a significant price increase, but not so early as to risk substantial losses. How can investors effectively determine appropriate entry and exit points within this volatile market?

Critical Analysis: Strengths and Weaknesses of the Strategic Fortunes Approach

The Strategic Fortunes approach, like any investment strategy, presents both significant opportunities and inherent risks:

Strengths:

- High-Growth Potential: Focuses on companies with explosive growth potential, enabling substantial returns.

- First-Mover Advantage: Capitalizes on significant price appreciation by identifying companies before they become mainstream, potentially generating much higher returns than later investments.

- Focus on Innovation: By prioritizing companies with a demonstrable "X-factor", the model increases the chances of success in a competitive landscape.

Weaknesses:

- High Risk: Early-stage company investments inherently carry much higher failure rates compared to established companies.

- Uncertain Timing: Predicting tipping points and optimal entry/exit points is complex due to market volatility and unexpected events.

- Subjectivity: Identifying the "X-factor" involves interpretation and judgment, making it somewhat subjective.

Actionable Insights: Tailored Advice for Different Stakeholders

The Strategic Fortunes approach affects various stakeholders differently. Let's examine practical advice tailored to each group:

| Stakeholder | Short-Term Actions | Long-Term Actions |

|---|---|---|

| Investors | Conduct rigorous due diligence, independently verify "tipping points," and diversify investments across multiple companies and sectors. | Continuously monitor investments, rebalance the portfolio regularly, and consider diversifying investment strategies to mitigate overall risk. |

| Strategic Fortune Team | Enhance transparency in the identification process, provide quantifiable performance metrics, and refine the "X-factor" identification methodology. | Develop a robust risk management framework, conduct historical backtesting of the methodology, and clearly articulate the limitations of the approach. |

| Regulators | Monitor for market manipulation involving early-stage tech investments. | Develop guidelines for evaluating early-stage tech investments and provide enhanced investor protection mechanisms. |

Risk Assessment and Mitigation Strategies

Investing in mid-cap tech companies involves significant risk. However, these risks can be mitigated through careful planning and execution:

- Diversification: Spread investments across multiple companies and sectors to reduce the impact of any single loss.

- Thorough Due Diligence: Rigorously research each company's financials, competitive landscape, and management team. Seek independent verification of claims.

- Establish Clear Risk Parameters: Define your risk tolerance and set stop-loss orders to mitigate potential losses.

- Stay Informed: Continuously monitor market trends, company performance, and technological advancements.

Conclusion: Harnessing the Potential of Strategic Fortunes

The Strategic Fortunes approach offers the potential for substantial returns by identifying and investing in high-growth mid-cap tech companies. However, this potential comes with significant risk. By following a structured approach, conducting thorough due diligence, and employing effective risk management strategies, investors can increase their chances of success. Remember: This guide is for informational purposes only and does not constitute financial advice.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Investing involves risk, including the potential loss of principal. Conduct your own thorough research, seek professional financial advice, and understand your risk tolerance before making any investment decisions.